Tax return depreciation calculator

11 hours agoSeptember 16 2022 at 534 pm. Depreciation is allowable as expense in Income Tax Act 1961 on basis of block of assets on Written Down Value WDV method.

Macrs Depreciation Calculator Irs Publication 946

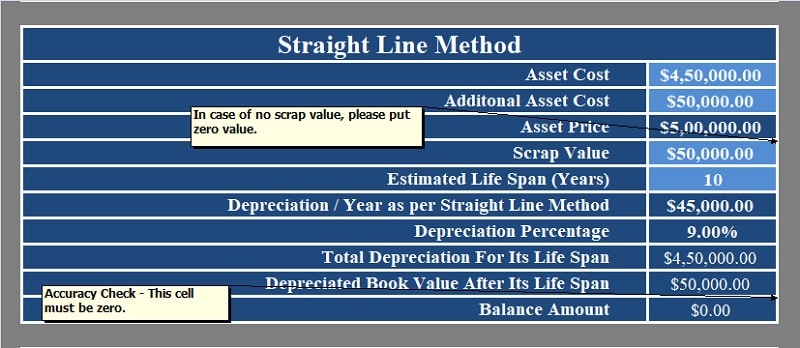

By using the formula for the straight-line method the annual depreciation is calculated as.

. Before you use this tool. Provide information on the. All tax refunds including the 62F refunds are taxable at the federal level only to the extent that an individual claimed itemized deductions on his or her federal return for Tax Year 2021 including.

MACRS Depreciation Calculator Help. All you need to do is input basic information like your. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments.

Ad Aprio performs hundreds of RD Tax Credit studies each year. This depreciation calculator is for calculating the depreciation schedule of an asset. It provides a couple different methods of depreciation.

To determine the amount youll be taxed on your depreciation recapture use our depreciation recapture tax calculator. TaxAdda Private Limited CIN - U93000RJ2019PTC067547 GSTIN - 08AAHCT6764E1Z1. The computer will be depreciated at 33333 per year for 3 years 1000 3 years.

A Tax Depreciation Schedule is prepared by a qualified Quantity Surveyor who calculates the available deductions for the property. Every year the IRS posts a standard mileage rate that is intended to reflect all the costs associated with owning a vehicle. A call center is available to residents.

16 hours agoResidents can request a copy of their 2021 Massachusetts tax returns on this webpage to help fill out the refund estimator tool. 17 hours agoBalers office said Friday the 13 is a preliminary estimate and will be finalized in late October after all 2021 tax returns are filed To be eligible you must have paid personal. Ad Enter Your Tax Information.

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Use Form 4562 to. Partner with Aprio to claim valuable RD tax credits with confidence.

D i C R i Where Di is the depreciation in year i C is the original purchase price or. This means the van depreciates at a rate of. First one can choose the straight line method of.

The tool includes updates to. If the computer has a residual value in 3 years of 200 then depreciation would be calculated. TDS advance tax and self-assessment tax payments made during the fiscal year should be.

35000 - 10000 5 5000. Looking at the depreciation table in Publication 946 the rate shows as 1819 for an asset placed into service in the 4th month which would give you 2547 in depreciation. Prepare federal and state income taxes online.

How to calculate what your Tax Refund will be when you submit your tax return to SARS Tax Refund. MACRS Depreciation Formula The MACRS Depreciation Calculator uses the following basic formula. You are provided with a Tax Depreciation Schedule that.

How to calculate the tax payable on Pension Provident or Retirement Annuity Fund. The MACRS depreciation calculator adheres to US income tax code as found in IRS Publication 946 opens in new tab. So what exactly will you get back from the state now that Democrats must admit soaking taxpayers for more than is needed to run the.

Above is the best source of help. Make the election under section 179 to expense certain property. See What Credits and Deductions Apply to You.

Depreciation on Straight Line Method SLM is not. Use the income tax bracket rate during FY 2022-23 to determine the annual tax bill. Gas repairs oil insurance registration and of course.

The Tax Depreciation Calculators objective is to provide the property investor an indicative estimate of the tax depreciation deductions applicable on certain properties. Claim your deduction for depreciation and amortization. E-File your tax return directly to the IRS.

This tool is available to work out the depreciation of capital allowance and capital works for both individual and businesses taxpayers.

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

Macrs Depreciation Calculator With Formula Nerd Counter

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Depreciation Formula Examples With Excel Template

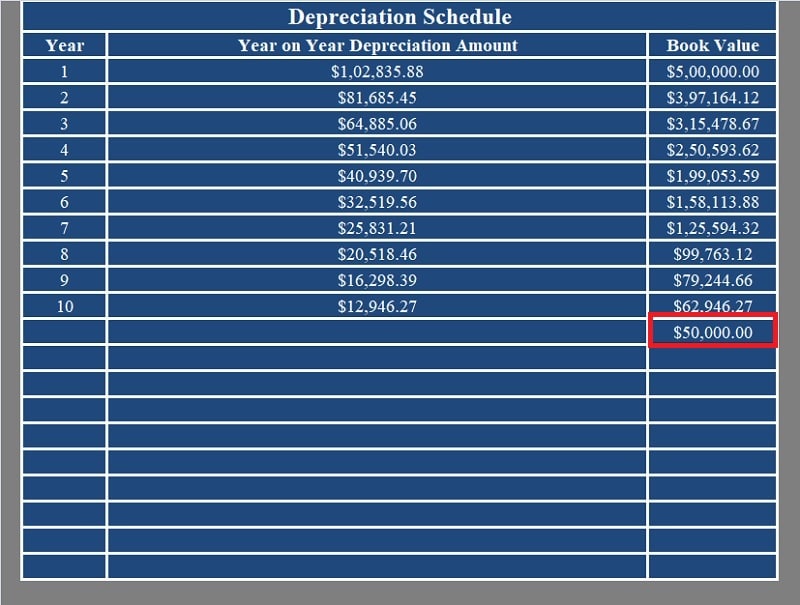

Depreciation Schedule Template For Straight Line And Declining Balance

Free Macrs Depreciation Calculator For Excel

:max_bytes(150000):strip_icc()/desk-writing-work-pen-office-business-676191-pxhere.com-ff806b26e1734bde82038a304564daf8.jpg)

What Is The Tax Impact Of Calculating Depreciation

/4562-0ccce5dc10454fcea87824d93ca6da97.jpg)

Form 4562 Depreciation And Amortization Definition

Download Depreciation Calculator Excel Template Exceldatapro

Guide To The Macrs Depreciation Method Chamber Of Commerce

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Calculate Depreciation Expense

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Macrs Depreciation Calculator Straight Line Double Declining

How To Use Rental Property Depreciation To Your Advantage

Download Depreciation Calculator Excel Template Exceldatapro

Download Depreciation Calculator Excel Template Exceldatapro